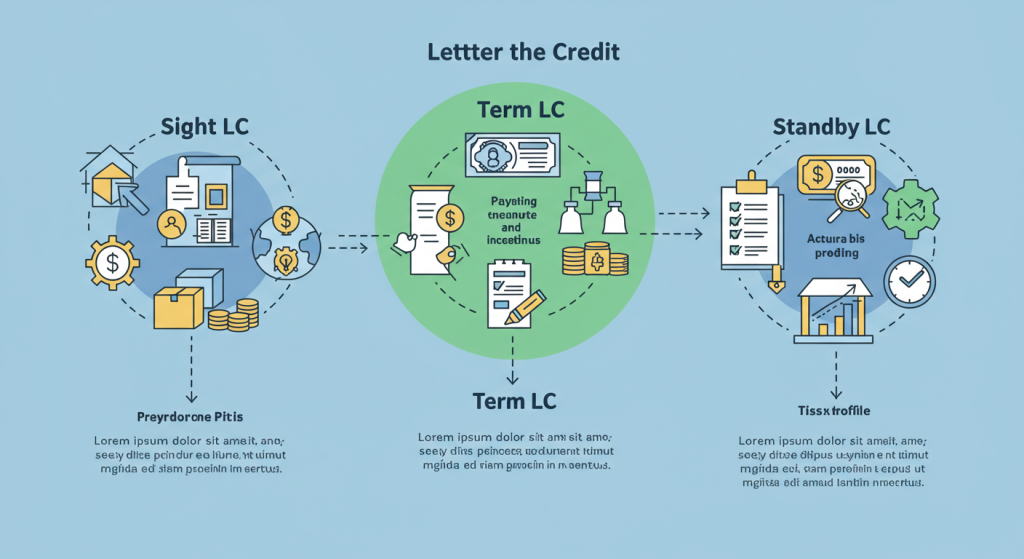

Understanding the Key Differences Between Sight LC, Term LC, and Standby LC – A Comprehensive Guide

In international trade, Letters of Credit (LC) play a crucial role in ensuring safe and secure transactions between buyers and sellers. There are various types of LCs, but three of the most common are Sight LC, Term LC, and Standby LC. In this article, we will explore the differences between each of them, their advantages, and how they help mitigate risks in global transactions.

1. Sight LC: Fast Payment Assurance 💸

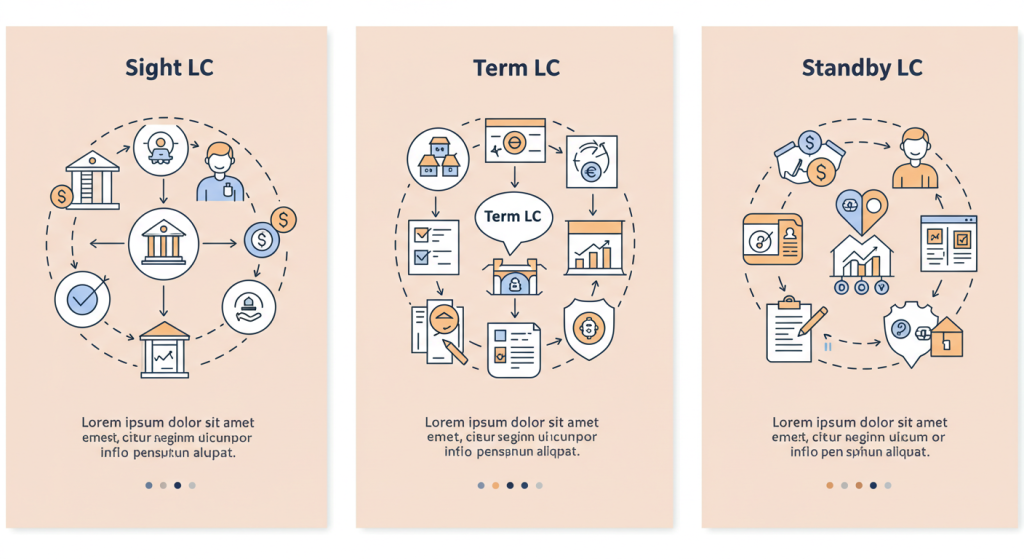

Sight LC is a type of letter of credit where payment is made immediately upon the presentation of the required documents by the seller. This is the simplest and most commonly used LC in international trade. Payment is usually made within a few days of presenting the necessary documents.

Key Features of Sight LC:

- Instant payment after document verification.

- Commonly used when there is mutual trust between the buyer and seller.

- Reduces the risk of non-payment for the seller.

Advantages:

- Immediate payment after presenting the documents.

- Provides more security for sellers, especially in high-value transactions.

2. Term LC: Flexible Payment Scheduling 📅

Term LC (also known as a Time LC) is different from Sight LC because the payment is deferred and made at a specific later date. The seller submits the required documents, but the payment is made after a delay (which can range from a few days to several months).

Key Features of Term LC:

- Payment is deferred and made on a specified date.

- The buyer has more time to arrange funds.

- Typically used for larger, longer-term transactions that require flexibility.

Advantages:

- Flexible payment terms, making it suitable for buyers with short-term cash flow limitations.

- Provides the seller with a guarantee of future payment, albeit with a delay.

3. Standby LC: Additional Security Guarantee 🔒

A Standby LC is essentially a guarantee from the buyer’s bank that ensures payment to the seller if the buyer fails to fulfill their obligations. This type of LC acts as a backup option and is usually used in transactions with higher risks or when the buyer lacks sufficient credit.

Key Features of Standby LC:

- Functions as a guarantee, not for direct payment.

- Payment is only made if the buyer fails to meet their obligations.

- Often used in long-term or high-risk transactions.

Advantages:

- Extra security for the seller, ensuring payment even if the buyer defaults on their commitments.

- Acts as a financial safety net in high-risk transactions.

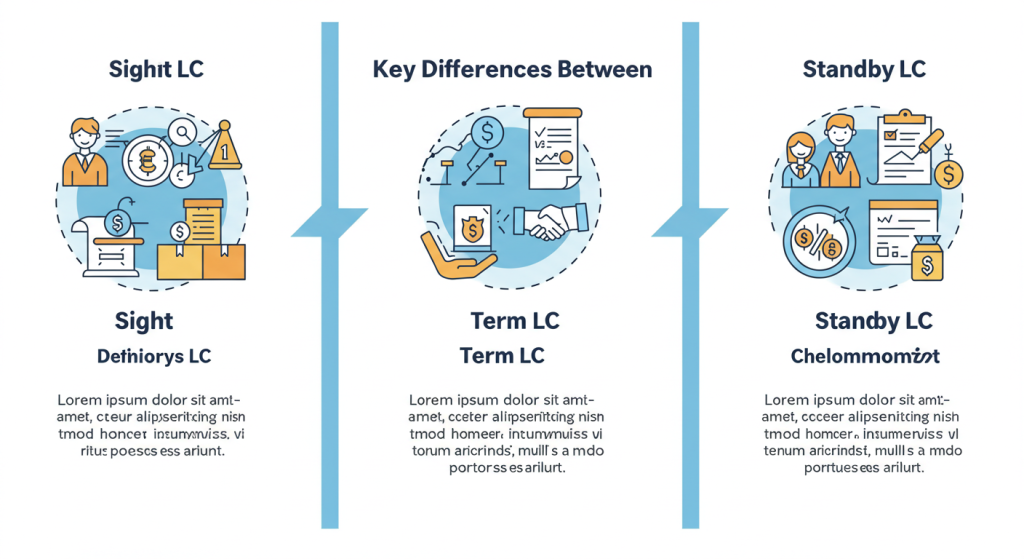

Why Understanding LC Types is Essential for Your Business

Understanding the differences between Sight LC, Term LC, and Standby LC is crucial for businesses involved in international trade. These types of letters of credit each offer distinct benefits depending on the needs of the buyer and seller.

For Sellers: Sight LC offers immediate payment, reducing financial uncertainty. Term LC guarantees future payment, providing a bit of flexibility in dealing with cash flow issues.

For Buyers: Term LC offers more flexible payment terms, allowing for sufficient time to arrange funds. Standby LC adds a layer of security, ensuring that the seller gets paid even if the buyer fails to meet their commitments.

Which LC Should You Choose? 🤔

The right LC for your transaction depends on several factors, including the level of trust between the buyer and seller, the payment terms, and the overall risk of the transaction. For high-risk transactions, Standby LC is the best option as it ensures payment even if things go wrong. For fast and secure transactions, Sight LC is ideal. If you need flexibility, Term LC might be the best fit.

Conclusion

In conclusion, understanding the differences between Sight LC, Term LC, and Standby LC is essential for mitigating risks and ensuring secure transactions in international trade. By choosing the appropriate LC for your business, you can ensure both parties have security and confidence, creating a safe and reliable trading environment.