In today’s fast-paced global economy, businesses and individuals alike often find themselves engaging in cross-border transactions. When sending money internationally, Telegraphic Transfer (TT) has emerged as one of the most widely used methods. But what exactly is TT, how does it work, and why is it so crucial for international trade? Let’s break it down in this ultimate guide. 💡

What is TT (Telegraphic Transfer)? 📤💳

Telegraphic Transfer (TT), also known as a wire transfer, is a method of transferring funds electronically between banks or financial institutions. It’s one of the most secure and efficient ways to send money internationally. TT transfers are usually used for business transactions, such as paying for goods, services, or investments across borders.

This system allows for quick and direct transfer of funds from one bank account to another without the need for physical cash or checks. TT is recognized for its speed, reliability, and security. Whether you’re paying a supplier in China, investing in a startup in Europe, or sending money to a family member abroad, TT makes international money transfers simple and efficient. 🌍💼

How Does TT Work? 🔄💡

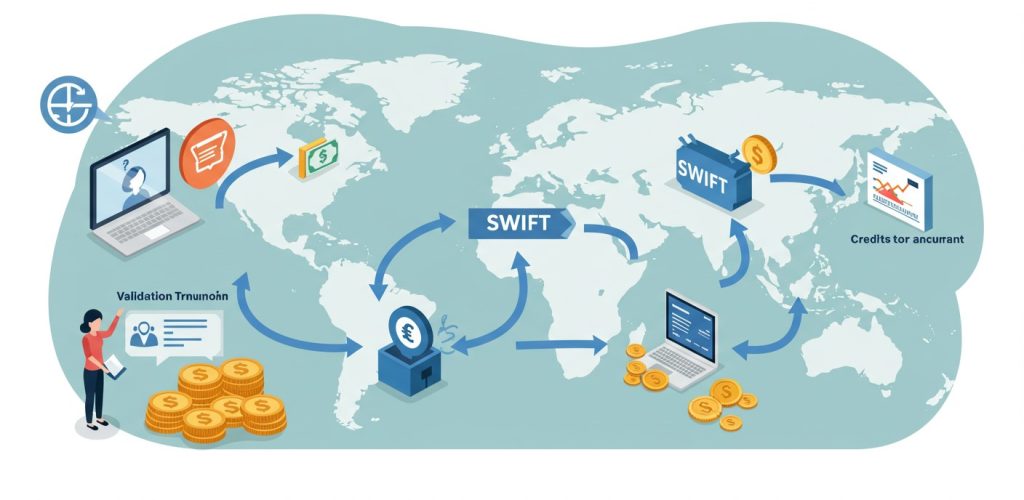

- Initiating the Transfer: The sender contacts their bank or financial institution to initiate the TT. They provide details about the transaction, including the recipient’s bank account number, name, address, and the bank’s SWIFT/BIC code.

- Verification and Processing: The sender’s bank verifies the details and processes the request, ensuring all necessary information is correct.

- Transmission of Funds: The funds are sent through a network of correspondent banks, often using SWIFT (Society for Worldwide Interbank Financial Telecommunication) messaging services. The money is transferred electronically, typically in real-time or within a few business days.

- Recipient Receives Funds: The recipient’s bank verifies the information and releases the funds to the recipient’s account. The entire process is completed securely.

Advantages of TT (Telegraphic Transfer) 💪💸

- Speed and Efficiency 🚀

- Fast Processing: TT transfers are typically processed within 1 to 3 business days, making it one of the fastest methods for international payments.

- No Paperwork: Unlike checks or physical transfers, TT doesn’t require the physical movement of documents, saving time and reducing administrative burden.

- Security 🔒

- Highly Secure: Since TT transactions are processed via secure banking systems, they’re far less susceptible to fraud or theft compared to other methods of payment.

- Tracking: Both the sender and recipient can track the transfer throughout its journey, ensuring transparency and reducing the likelihood of errors.

- Global Reach 🌐

- Wide Acceptance: TT can be used to send money to virtually any country, making it ideal for businesses that operate on a global scale or individuals with international commitments.

- Currency Conversion: TT allows for easy currency conversion, which is a great feature when dealing with international suppliers or partners in different currencies.

- Simplicity 💼

- No Middlemen: Unlike methods like checks or cash transactions, TT allows direct communication between the sender’s and receiver’s banks. This reduces complexity and minimizes the risk of errors.

- Easier Business Transactions: Businesses can rely on TT for paying international suppliers or contractors, ensuring that funds are transferred accurately and promptly.

When Should You Use TT? 📅

- Paying International Suppliers 🌏

- When you need to pay for goods or services in another country, TT offers a secure and fast option. It ensures that your supplier receives payment without delays, which is vital for maintaining good business relationships.

- Investment Payments 📈

- If you’re making an investment in a foreign company or project, TT is the most reliable way to send large sums of money across borders.

- Sending Money to Family Abroad 🌍💖

- TT isn’t just for businesses. It’s also an excellent option for individuals who need to send money to family or friends in another country quickly and securely.

- Large Transactions 💰

- TT is typically used for larger sums of money. If you’re transferring a significant amount, like for property purchase or business expansion, TT is often the safest and most efficient method.

Disadvantages of TT (Telegraphic Transfer) ⚠️

- High Fees 💸

- One of the main drawbacks of using TT is the cost. Banks charge fees for both sending and receiving transfers, and these can add up, especially for large sums.

- Banking Hours and Delays ⏰

- Although TT transfers are fast, they are still subject to banking hours and holidays. If you’re sending money around the world, the timing of the transaction could impact how quickly the recipient receives the funds.

- Currency Conversion Fees 💱

- When transferring money in a different currency, you may face conversion fees, which can increase the total cost of the transfer.

- Risk of Errors ❗

- If any detail in the transfer is incorrect, it can delay the process or even result in the funds being returned to the sender, causing inconvenience and extra costs.

Conclusion: Why TT is Essential for International Business and Personal Transactions 🌍💡

In the world of international trade, Telegraphic Transfer (TT) offers businesses and individuals an efficient, secure, and reliable method for transferring funds across borders. Whether for paying suppliers, making investments, or sending money to loved ones abroad, TT ensures that funds are sent quickly, securely, and with minimal hassle. 💪💸

While it may come with some fees and potential delays, the benefits of using TT far outweigh the drawbacks. With its global reach, security, and simplicity, it’s no wonder that TT is a go-to option for international transactions. 🌐💼